MD Anderson Legacy Society

Impact Lives Today and Tomorrow

Monroe Dunaway Anderson

The MD Anderson Legacy Society honors individuals who choose to invest in the future with a planned gift benefiting MD Anderson and our mission areas of research, education and prevention, and patient assistance programs. Creating a legacy that extends beyond your lifetime requires wisdom, vision and a plan tailored to your unique circumstances.

Planned gifts include:

- Bequests

- Charitable gift annuities

- Life insurance

- Retirement assets

- Stocks and appreciated assets

- Real estate

- Personal property

- Trusts

The experienced professionals on our Trusts, Estates, and Gift Planning team can assist you and your financial/legal advisors in achieving a giving plan that aligns with your interests and fulfills your desire to help eliminate cancer.

Regardless of the amount or type of giving you choose, you can improve the outlook for cancer patients. Over the years, Legacy Society members have provided the seed money for basic science and clinical research that have enhanced our patient programs, strengthened and broadened our professional programs, and contributed to capital projects such as new clinics and research facilities.

Our History

Monroe Dunaway Anderson, a banker and business owner/entrepreneur from Jackson, Tenn., had huge success in Houston and decided to make a long-term investment in the future of the city that had given him such opportunity. Mr. Anderson created the M.D. Anderson Foundation, which today has paid greater dividends in terms of improving human lives than the founder ever could have imagined. In 1941, two years after Mr. Anderson’s death, the foundation trustees approved a $500,000 matching grant that enabled the funding of what is now MD Anderson Cancer Center. More than 1 million people in Houston and beyond have benefited from world-class cancer care, research and education because Monroe Dunaway Anderson transformed his vision into a long-range, well-managed plan of action.

Following in the Footsteps

When Mr. Anderson established his foundation in 1936, the survival rate for cancer patients was 25%. Today, the five-year survival rate for all cancer combined is 69%. This tremendous progress is due both to the outstanding advances made in cancer research and treatment, many of which were pioneered by the faculty and staff of MD Anderson, and to the contributions of friends of the institution who share the vision and generosity of spirit that motivated Mr. Anderson.

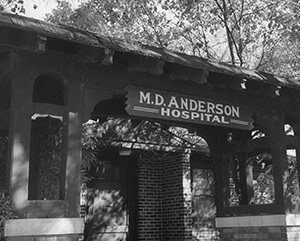

MD Anderson — now

MD Anderson — then

Benefits of a Planned Gift

It would be our pleasure to welcome you into this honored circle of recognition. We would like to acknowledge your support as a member of the MD Anderson Legacy Society by including you in special mailings and extending invitations to programs and events. If you wish, we will be happy to recognize you appropriately in select institutional publications.

In addition to making an impact on cancer research, another advantage of a planned gift to MD Anderson is the potential tax benefit, both immediate and for your estate. For example:

- Donors who contribute appreciated property (securities or real estate held more than a year) receive a charitable deduction for the full market value of the asset and pay no capital gains tax on the transfer.

- Donors who establish a life-income gift (e.g., a charitable gift annuity) receive a tax deduction and, if they fund their gift with appreciated property, pay no up-front capital gains tax on the transfer.

- Gifts payable to MD Anderson upon the donor’s death (a bequest or beneficiary designation on a life insurance policy or retirement account) are exempt from estate tax.

Thank you for your thoughtful consideration. We hope you will be the next member of the MD Anderson Legacy Society. Today’s planned gift makes tomorrow’s research breakthroughs possible.

Free Estate Planning Tool

Join fellow MD Anderson supporters using Giving Docs, a safe, secure and free-for-life suite of estate plan essentials. If you choose to include MD Anderson in your estate plans, you'll be eligible for Legacy Society benefits!

Get Started